IPython 与 RQAlpha

加载 RQAlpha magic

In [3]:

%load_ext rqalpha

The rqalpha extension is already loaded. To reload it, use:

%reload_ext rqalpha

查看 RQAlpha magic 帮助

我们可以通过 %%rqalpha 直接在 cell 中运行回测代码。

%%rqalpha 后面的参数等价于在 CLI 中后面的 rqalpha run 的参数

In [2]:

%%rqalpha -h

""

Usage: ipykernel_launcher.py [OPTIONS]

Start to run a strategy

Options:

-h, --help Show this message and exit.

-d, --data-bundle-path PATH

-f, --strategy-file PATH

-s, --start-date DATE

-e, --end-date DATE

-bm, --benchmark TEXT

-mm, --margin-multiplier FLOAT

-a, --account TEXT... set account type with starting cash

-fq, --frequency [1d|1m|tick]

-rt, --run-type [b|p]

--resume

--source-code TEXT

-l, --log-level [verbose|debug|info|error|none]

--disable-user-system-log disable user system log stdout

--disable-user-log disable user log stdout

--locale [cn|en]

--extra-vars TEXT override context vars

--enable-profiler add line profiler to profile your strategy

--config TEXT config file path

-mc, --mod-config TEXT... mod extra config

--stock-t1 / --no-stock-t1 [sys_accounts] enable/disable stock T+1

--report PATH [sys_analyser] save report

-o, --output-file PATH [sys_analyser] output result pickle file

-p, --plot / --no-plot [sys_analyser] plot result

--plot-save TEXT [sys_analyser] save plot to file

--progress [sys_progress]show progress bar

--no-short-stock / --short-stock

[sys_risk] enable stock shorting

--signal [sys_simulation] exclude match engine

-sp, --slippage FLOAT [sys_simulation] set slippage

-cm, --commission-multiplier FLOAT

[sys_simulation] set commission multiplier

-me, --match-engine [current_bar|next_bar|last|best_own|best_counterparty]

[Deprecated][sys_simulation] set matching

type

-mt, --matching-type [current_bar|next_bar|last|best_own|best_counterparty]

[sys_simulation] set matching type

使用 %%rqalpha 进行回测

In [3]:

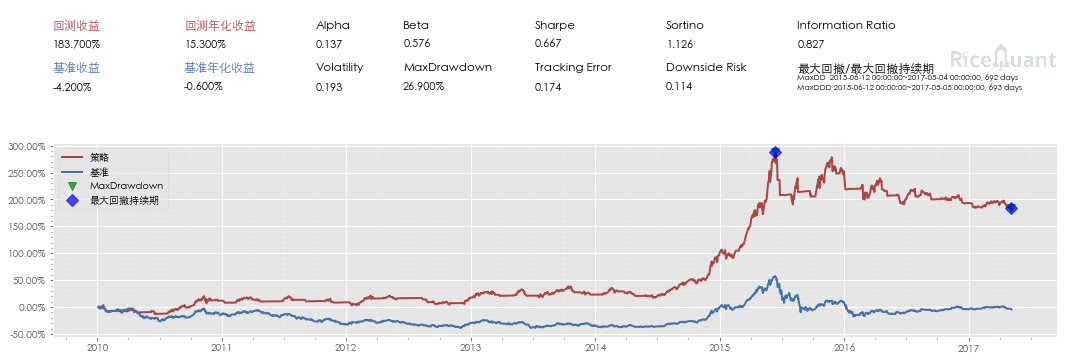

%%rqalpha -s 20100101 -e 20170505 -p -bm 000001.XSHG --account stock 100000

def init(context):

context.stocks = ['000300.XSHG', '000905.XSHG', '000012.XSHG']

def handle_bar(context, bar_dict):

[hs, zz, gz] = context.stocks

hs_history20 = history_bars(hs, 20, '1d', 'close')

zz_history20 = history_bars(zz, 20, '1d', 'close')

hsIncrease = hs_history20[-1] - hs_history20[0]

zzIncrease = zz_history20[-1] - zz_history20[0]

positions = context.portfolio.positions

[hsQuality, zzQuality, gzQuality] = [positions[hs].quantity, positions[zz].quantity, positions[gz].quantity]

if hsIncrease < 0 and zzIncrease < 0:

if hsQuality > 0: order_target_percent(hs, 0)

if zzQuality > 0: order_target_percent(zz, 0)

order_target_percent(gz, 1)

elif hsIncrease < zzIncrease:

if hsQuality > 0: order_target_percent(hs, 0)

if gzQuality > 0: order_target_percent(gz, 0)

order_target_percent(zz, 1)

else:

if zzQuality > 0: order_target_percent(zz, 0)

if gzQuality > 0: order_target_percent(gz, 0)

order_target_percent(hs, 1)

#logger.info("positions hs300: " + str(hsQuality) + ", zz500: " + str(zzQuality) + ", gz: " + str(gzQuality))

获取回测报告

运行完回测后,报告会自动存储到 report 变量中。可以直接通过

report 变量获取当次回测的结果。

另外 rqalpha 的 mod 的输出会自动存储在 results 变量中。

In [4]:

results.keys()

Out[4]:

dict_keys(['sys_analyser'])

In [5]:

report.keys()

Out[5]:

dict_keys(['summary', 'trades', 'portfolio', 'benchmark_portfolio', 'stock_account', 'stock_positions'])

In [6]:

report.trades[:5]

Out[6]:

| commission | exec_id | last_price | last_quantity | order_book_id | order_id | position_effect | side | symbol | tax | trading_datetime | transaction_cost | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| datetime | ||||||||||||

| 2010-01-04 15:00:00 | 79.961424 | 1498453688 | 122.34 | 817 | 000012.XSHG | 1498453672 | None | BUY | 国债指数 | 0 | 2010-01-04 15:00:00 | 79.961424 |

| 2010-01-06 15:00:00 | 79.948352 | 1498453689 | 122.32 | 817 | 000012.XSHG | 1498453673 | None | SELL | 国债指数 | 0 | 2010-01-06 15:00:00 | 79.948352 |

| 2010-01-06 15:00:00 | 76.444704 | 1498453690 | 4550.28 | 21 | 000905.XSHG | 1498453674 | None | BUY | 中证500(沪) | 0 | 2010-01-06 15:00:00 | 76.444704 |

| 2010-01-07 15:00:00 | 74.913888 | 1498453691 | 4459.16 | 21 | 000905.XSHG | 1498453675 | None | SELL | 中证500(沪) | 0 | 2010-01-07 15:00:00 | 74.913888 |

| 2010-01-07 15:00:00 | 78.180552 | 1498453692 | 122.31 | 799 | 000012.XSHG | 1498453676 | None | BUY | 国债指数 | 0 | 2010-01-07 15:00:00 | 78.180552 |

In [7]:

report.portfolio[:5]

Out[7]:

| cash | market_value | static_unit_net_value | total_value | unit_net_value | units | |

|---|---|---|---|---|---|---|

| date | ||||||

| 2010-01-04 | -31.741 | 99951.78 | 1.000 | 99920.039 | 0.999200 | 100000.0 |

| 2010-01-05 | -31.741 | 99902.76 | 0.999 | 99871.019 | 0.998710 | 100000.0 |

| 2010-01-06 | 4191.426 | 95555.88 | 0.999 | 99747.306 | 0.997473 | 100000.0 |

| 2010-01-07 | -44.999 | 97725.69 | 0.997 | 97680.691 | 0.976807 | 100000.0 |

| 2010-01-08 | -44.999 | 97733.68 | 0.977 | 97688.681 | 0.976887 | 100000.0 |

In [8]:

report.stock_positions[:5]

Out[8]:

| avg_price | last_price | market_value | order_book_id | quantity | symbol | |

|---|---|---|---|---|---|---|

| date | ||||||

| 2010-01-04 | 122.34 | 122.34 | 99951.78 | 000012.XSHG | 817 | 国债指数 |

| 2010-01-05 | 122.34 | 122.28 | 99902.76 | 000012.XSHG | 817 | 国债指数 |

| 2010-01-06 | 122.34 | 122.32 | 0.00 | 000012.XSHG | 0 | 国债指数 |

| 2010-01-06 | 4550.28 | 4550.28 | 95555.88 | 000905.XSHG | 21 | 中证500(沪) |

| 2010-01-07 | 4550.28 | 4459.16 | 0.00 | 000905.XSHG | 0 | 中证500(沪) |

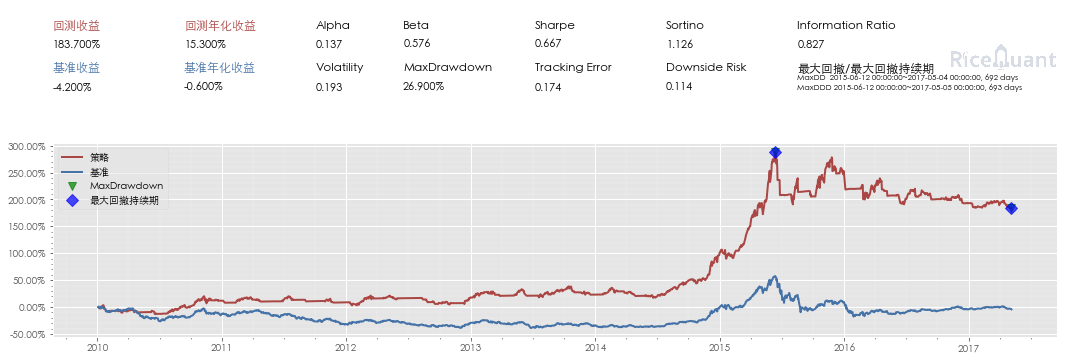

使用 run_func 运行回测

In [9]:

config = {

"base": {

"start_date": "2010-01-01",

"end_date": "2017-05-05",

"benchmark": "000001.XSHG",

"accounts": {

"stock": 100000

}

},

"extra": {

"log_level": "info",

},

"mod": {

"sys_analyser": {

"enabled": True,

"plot": True,

},

}

}

from rqalpha.api import *

from rqalpha import run_func

def init(context):

context.stocks = ['000300.XSHG', '000905.XSHG', '000012.XSHG']

def handle_bar(context, bar_dict):

[hs, zz, gz] = context.stocks

hs_history20 = history_bars(hs, 20, '1d', 'close')

zz_history20 = history_bars(zz, 20, '1d', 'close')

hsIncrease = hs_history20[-1] - hs_history20[0]

zzIncrease = zz_history20[-1] - zz_history20[0]

positions = context.portfolio.positions

[hsQuality, zzQuality, gzQuality] = [positions[hs].quantity, positions[zz].quantity, positions[gz].quantity]

if hsIncrease < 0 and zzIncrease < 0:

if hsQuality > 0: order_target_percent(hs, 0)

if zzQuality > 0: order_target_percent(zz, 0)

order_target_percent(gz, 1)

elif hsIncrease < zzIncrease:

if hsQuality > 0: order_target_percent(hs, 0)

if gzQuality > 0: order_target_percent(gz, 0)

order_target_percent(zz, 1)

else:

if zzQuality > 0: order_target_percent(zz, 0)

if gzQuality > 0: order_target_percent(gz, 0)

order_target_percent(hs, 1)

results = run_func(init=init, handle_bar=handle_bar, config=config)

In [10]:

report = results["sys_analyser"]

In [11]:

report["trades"][:5]

Out[11]:

| commission | exec_id | last_price | last_quantity | order_book_id | order_id | position_effect | side | symbol | tax | trading_datetime | transaction_cost | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| datetime | ||||||||||||

| 2010-01-04 15:00:00 | 79.961424 | 1498454089 | 122.34 | 817 | 000012.XSHG | 1498454073 | None | BUY | 国债指数 | 0 | 2010-01-04 15:00:00 | 79.961424 |

| 2010-01-06 15:00:00 | 79.948352 | 1498454090 | 122.32 | 817 | 000012.XSHG | 1498454074 | None | SELL | 国债指数 | 0 | 2010-01-06 15:00:00 | 79.948352 |

| 2010-01-06 15:00:00 | 76.444704 | 1498454091 | 4550.28 | 21 | 000905.XSHG | 1498454075 | None | BUY | 中证500(沪) | 0 | 2010-01-06 15:00:00 | 76.444704 |

| 2010-01-07 15:00:00 | 74.913888 | 1498454092 | 4459.16 | 21 | 000905.XSHG | 1498454076 | None | SELL | 中证500(沪) | 0 | 2010-01-07 15:00:00 | 74.913888 |

| 2010-01-07 15:00:00 | 78.180552 | 1498454093 | 122.31 | 799 | 000012.XSHG | 1498454077 | None | BUY | 国债指数 | 0 | 2010-01-07 15:00:00 | 78.180552 |

In [ ]: